28+ buying points on a mortgage

With the purchase of three discount points. Web Volume was 44 lower than the same week one year ago and is now sitting at a 28-year low.

![]()

Should You Pay For Mortgage Discount Points Nerdwallet

Get Instantly Matched With Your Ideal Mortgage Lender.

. Ad Take the First Step Towards Your Dream Home See If You Qualify. Each mortgage discount point usually costs one percent of your total loan amount and lowers the interest rate on your monthly payments by 025. Web Trying to decide whether to pay for mortgage points or use the money to reduce your down payment.

Each mortgage discount point usually costs 1 of your total loan amount and lowers the interest rate on your monthly payments by 025. For example if your mortgage is 300000 and your interest rate is 35 one point costs 3000 and lowers your monthly interest to 325. Calculate savings with the free tool from Univest.

The fee for the points will be paid directly to the lender as part of your closing. So if youre taking out a 300000 home loan with a 10 down payment making your loan amount 270000. Generally points can be purchased in increments down to eighths of a percent or 0125.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Save Real Money Today. Web Extra upfront cost of buying points.

Qualify In 2 Min Now. Web Mortgage points are fees that you pay your mortgage lender upfront in order to reduce the interest rate on your loan and in turn your monthly payments. Compare Your Best Mortgage Loans View Rates.

Web You can buy mortgage points by making an arrangement with your lender before the loan closes. Paying for discount points is often called buying down the rate and is totally optional. Web How mortgage points work.

Get The Time Money and Peace Of Mind You Need. Check Your Official Eligibility. Web 1 hour agoCommon temporary buydown terms are 2-1 and 1-0 where the first number is the rate reduction you receive in the first year and the second number is the rate.

Web Buying mortgage points on a property you think of as your starter home isnt always the best use of your hard-earned money. If you have a little cash left over month to month. Updated Rates for Today.

If Your Homes Worth 150K EasyKnock Can Help. The initial interest rate was 3. Updated FHA Loan Requirements for 2023.

Web Buying mortgage points is a way to lower your interest rate at closing by prepaying some interest upfront. How Much Does One Point Lower Your Interest Rate. Web Up to 25 cash back Say you buy one point on a mortgage loan of 300000 which costs 3000 1 of the loan amount.

Easily Compare Mortgage Rates and Find a Great Lender. Check Your Official Eligibility. Ad Looking for a Home Equity Loan Alternative.

Ad 10 Best Home Loan Lenders Compared Reviewed. Web Most mortgage lenders cap the number of points you can buy. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Web On a 100000 mortgage with an interest rate of 3 your monthly payment for principal and interest is 421 per month. Web To buy mortgage points you pay your lender a one-time fee as part of your closing costs. Web Buying points on a mortgage is a good idea only if you plan to make payments on your loan long enough to break even when what you paid for points.

Web How do mortgage points work. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web Each mortgage point you buy lowers your interest rate by 025.

Ad Get the Right Housing Loan for Your Needs. Web Each point purchased costs 1 of the mortgage amount so one point on a 400000 mortgage would cost 4000. Because each point lowers.

Updated FHA Loan Requirements for 2023. Ad First Time Home Buyer. Lock Your Rate Today.

Web Mortgage points are fees you pay a lender to reduce the interest rate on a mortgage. Savings from buying points. Borrowers can also often buy fractions of a point as well.

Find Fresh Content Updated Daily For Buying points mortgage. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. 10 Best Mortgage Loans Lenders Compared Reviewed.

The actual savings and interest rate reduction will vary depending on your loan. This as the average contract interest rate for 30-year fixed-rate. Compare Offers Side by Side with LendingTree.

Web If youre shopping for a mortgage for that theoretical 400000 home buying two points could lower the interest rate on a 30-year fixed-rate mortgage from 6 close. Comparisons Trusted by 55000000. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

It will also get you a lower monthly mortgage payment and youll pay.

Buy Platinum Home Mortgage Corporation

Mortgage Points Calculator Nerdwallet

How Much A 250 000 Mortgage Will Cost You Credible

Is Buying Mortgage Points Worth It Mortgage Points Explained Youtube

42 Trending Credit Repair Businesses 2023 Starter Story

Power Players 2022 Memphis Magazine

What Are Mortgage Points And How Do They Work

Is Buying Mortgage Points Worth It Mortgage Points Explained Youtube

Why Should You Buy Cars That Are A Couple Of Years Old Instead Of New Cars From A Financial Point Of View Quora

Eu Council Manual Law Enforcement Information Exchange 7779 15

Buy Mortgage Points To Lower Your Interest Rate Youtube

Buying Mortgage Points Here S Who Should And Should Not Do It Marketwatch

Should I Buy Mortgage Points Experian

What Are Mortgage Points And How Do They Work

Mortgage Points A Complete Guide Rocket Mortgage

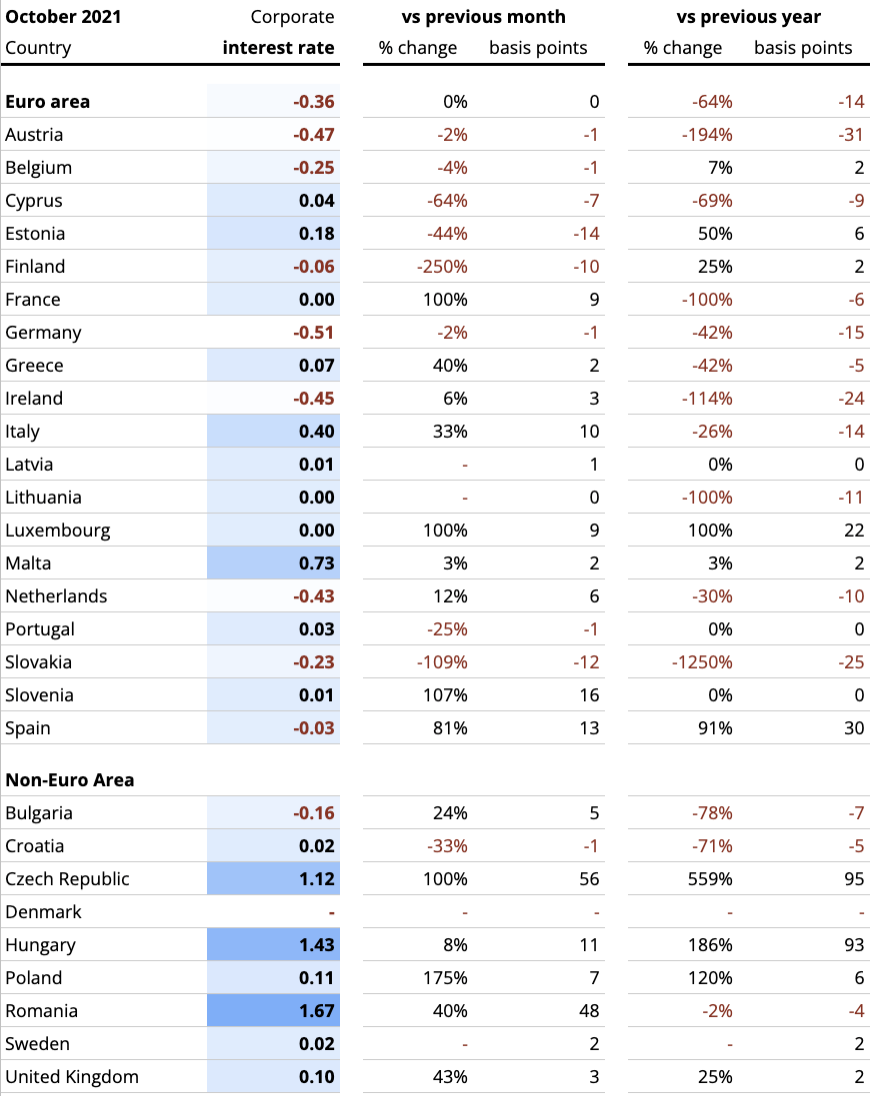

Raisin S Interest Rate Tracker

Mortgage Points Calculator Should You Buy Points